How you can beat the market using this conservative dividend strategy, even if you are brand new to investing.

Get Access Now

Whoever said that investing for dividends had to be boring?

Dynamic Dividends is a systematic approach to investing in high-quality dividend stocks.

The strategy begins by screening for companies where the dividend per share has not decreased over the past nine years within consecutive years.

Next, the screen only selects those stocks where the dividend yield is 2% or greater.

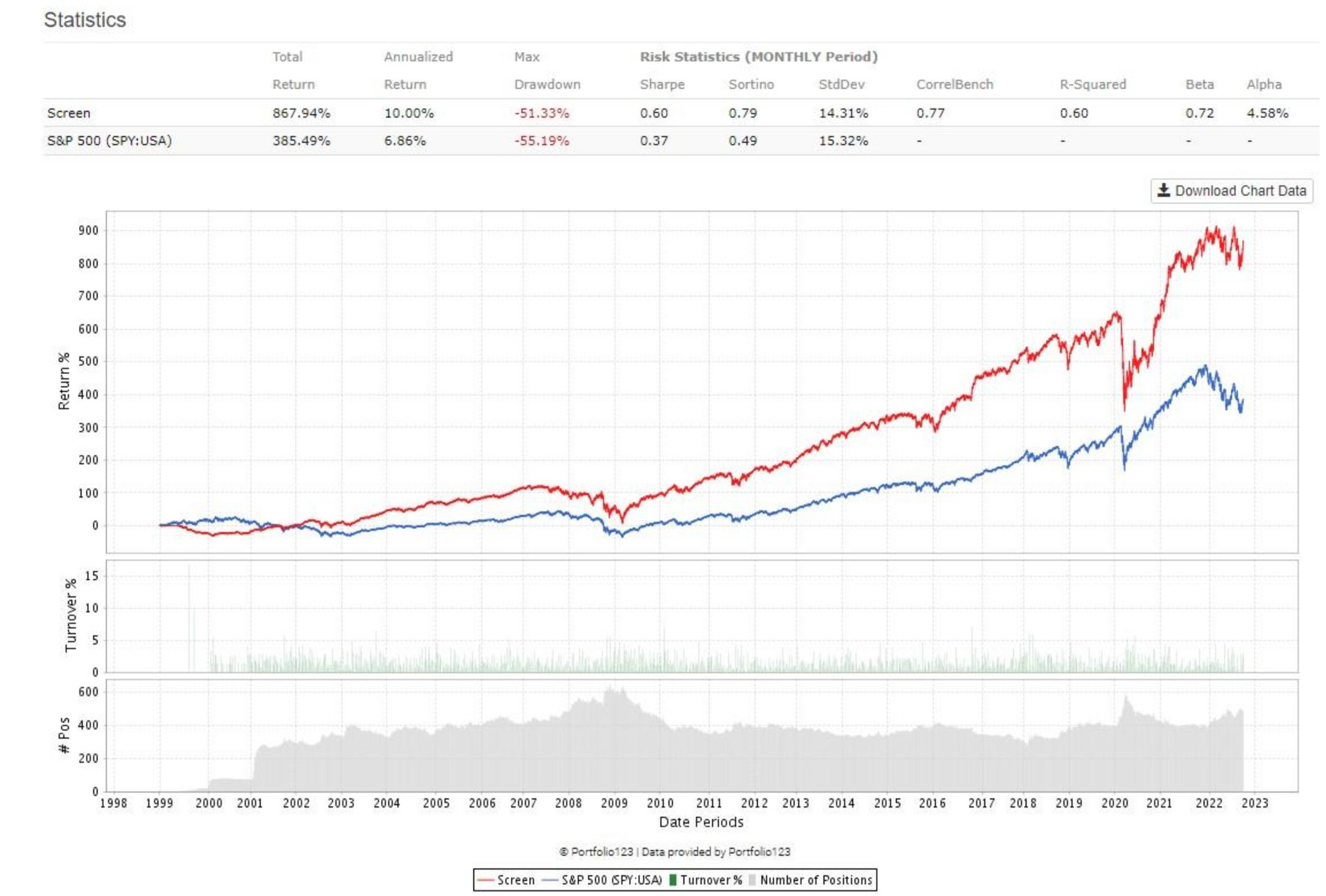

This results in approximately 300 stocks for which the aggregate performance is shown below.

Since 1999, the all-stock universe has returned 10% annually vs. 6.86% for the S&P 500.

But you can do better than that using our simple 3-step process demonstrated below.

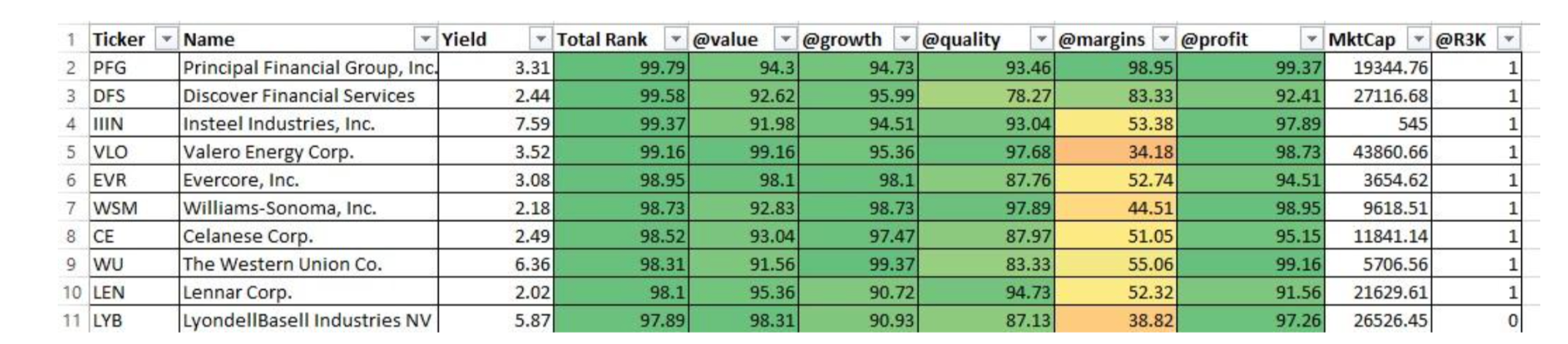

Subscribers receive monthly updates of our proprietary ranked database.

Every stock is evaluated on a variety of metrics that includes value, growth quality, margins, and profitability. Stocks are assigned a Total Rank score between 0 (worse) to 100 (best).

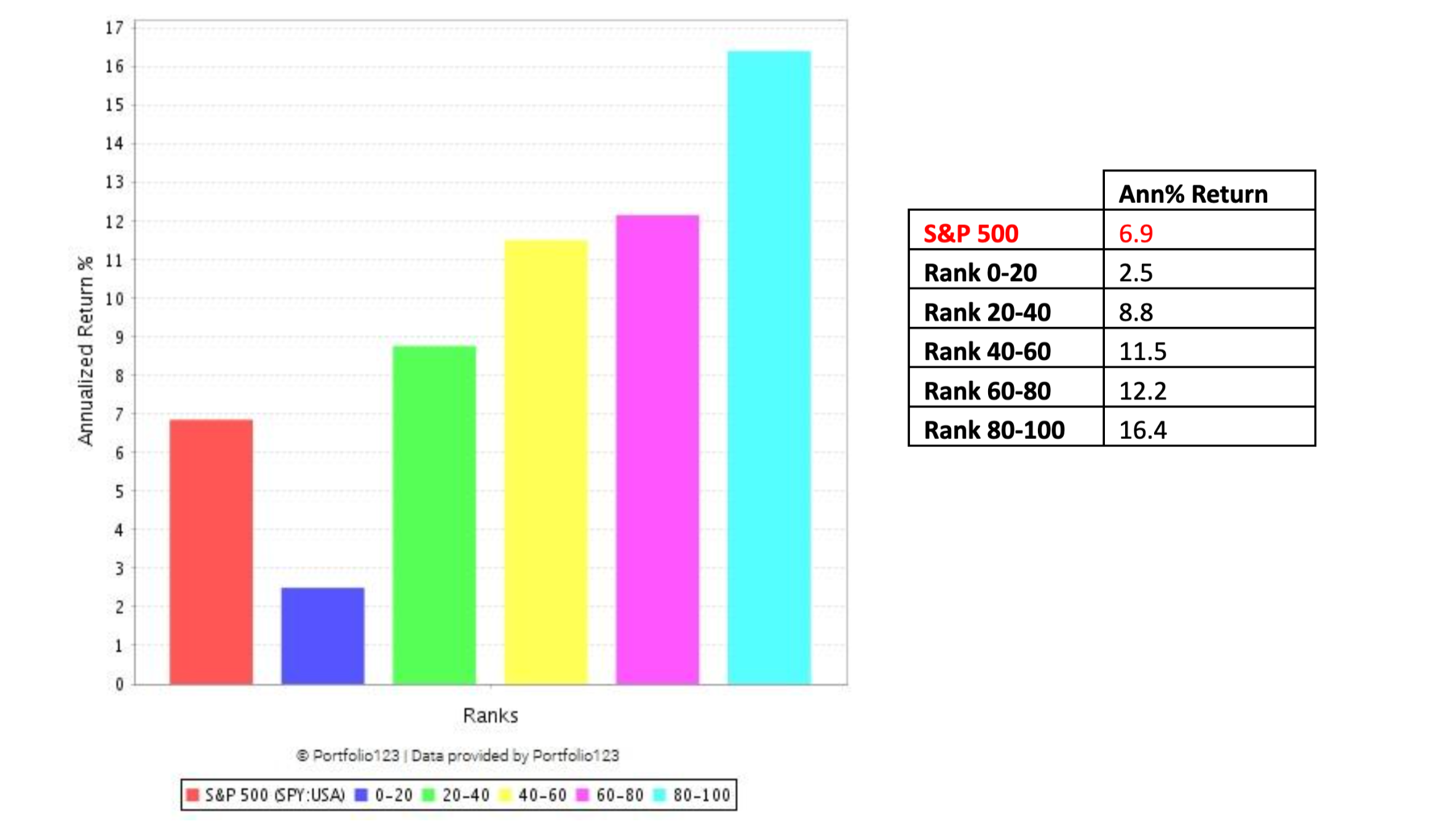

Investing in only Top-Ranked (scores of 80 or greater) results in annualized return of 16.4%

That's not only a market beating return, but it beats virtually every mutual fund and professional manager with a track record since then.

Bonus Technique #1: Stocks Under the Radar

Every monthly database update includes a designation as to whether or not a stock is a member of the Russell 3000 Index.

Stocks not in the Russell 3000 index are more under the radar and perform much better.

Below is a chart outlining stocks with a total rank above 80 that are not found in the Russell 3000 index. The result has been an annual return of almost 21% since 1999.

Bonus Technique #2: Small & Mighty

A second approach that also works well is to look for small market capitalization stocks. The chart below shows the performance of all stocks with a total rank above 80 but where the market cap is $1B or less.

The results have been a market-crushing 23.69% annualized return on highly ranked dividend stocks that have smaller market caps!

Dynamic Dividends is a systematic and quantitative approach to investing in dividend stocks that can be implemented using our easy-to-follow process.

Step 1.

Review our spreadsheet and buy only stocks with a Total Rank of 80 or more as a general rule.

Step 2.

Consider investing in stocks that are lesser known (not in a popular index such as Russell 3000) or which have smaller market caps (e.g. less than $1B)

Step 3.

Remove and replace any stock that has a total rank that drops too low. The number you choose will depend on how little turnover you desire.

Free Bonus:

What if you could know with confidence, the best time to invest in the stock market and the exact stocks to buy, without guesswork or spending hours and hours doing research?

"Offense or Defense?" is our guide to using our Demand Indicator that has never missed signaling a major market turn.

By following this indicator you will be able to identify low-risk buying opportunities with precision. Even more important, this indicator will warn you when you should consider taking profits or hedging your portfolio.

When used with Dynamic Dividends, you will have a complete operating system providing you with the what and the when to invest.

Updates to the Demand Indicator are provided daily for all subscribers.

*Dynamic Dividends is included with all regular membership plans at no extra charge or is available as a stand-alone purchase for investors who want access to only this strategy.